Updating The List for Adventures in the Forgotten Realms

Updating The List for Adventures in the Forgotten Realms

Posted in Feature on July 6, 2021

By Wizards of the Coast

Dungeons & Dragons: Adventures in the Forgotten Realms arrives in local game stores worldwide on July 23, and this first-time crossover of Magic: The Gathering and Dungeons & Dragons brings with it exciting new cards and Booster Fun variants for players.

It also brings with it another update to The List! This is a list of interesting cards selected from across Magic history, changing from release to release as it’s adjusted for the themes of the set.

Found only in Set Boosters, a card from The List appears 25% of the time in the final card slot. All rarities are represented, from common all the way up to mythic rare: commons will appear more often than uncommons, uncommons more than rares, and rares more often than mythic rares.

Cards are legal in whatever formats they are currently legal in; being on The List does not make a card legal in Standard.

Click to see past versions of The List

- The List for Modern Horizons 2

- The List for Strixhaven: School of Mages

- The List for Kaldheim

- The List for Zendikar Rising

Below you’ll find a full list of the cards on The List for Adventures in the Forgotten Realms, as well as lists of the cards added and removed.

(Note: Card images that appear may not match the version found on The List. See the set identifier in the righthand column for the version included in The List.)

Click to see added cards

| Card Name | Set |

|---|---|

| Air Elemental | P02 |

| Arcades, the Strategist | M19 |

| Assassin’s Blade | POR |

| Balefire Dragon | ISD |

| Captivating Vampire | M11 |

| Cloud Key | FUT |

| Coveted Jewel | C18 |

| Daxos the Returned | C15 |

| Demonic Tutor | UMA |

| Doubling Cube | 10E |

| Dragonlord Dromoka | DTK |

| Dungeon Shade | STH |

| Eiganjo Castle | CHK |

| Expedition Map | 2XM |

| Fireball | DD2 |

| Gauntlet of Power | TSP |

| Gemstone Caverns | TSP |

| Golem’s Heart | SOM |

| Grenzo, Dungeon Warden | A25 |

| Haunted Plate Mail | M14 |

| Hellkite Overlord | ALA |

| Hermit Druid | STH |

| Invisibility | M15 |

| Invisible Stalker | ISD |

| Jump | M10 |

| Korvold, Fae-Cursed King | ELD |

| Nightmare | AKH |

| Noxious Ghoul | LGN |

| Orcish Lumberjack | DDL |

| Polymorph | M10 |

| Quest for the Holy Relic | ZEN |

| Raven Familiar | C13 |

| Resurrection | UMA |

| Silence | TSR |

| Sleep | C15 |

| Sleeping Potion | PLS |

| Sneak Attack | USG |

| Sorcerer’s Wand | DAR |

| Staff of Domination | 5DN |

| Stone Giant | DDI |

| Tempest Djinn | DAR |

| Trade Routes | MMQ |

| Transmogrifying Wand | M19 |

| Traverse the Outlands | C17 |

| Treasure Trove | EXO |

| Twinblade Paladin | M20 |

| Undead Slayer | M10 |

| Will-o’-the-Wisp | A25 |

| Yisan, the Wanderer Bard | M15 |

| Tymaret, Chosen from Death | THB |

To make room for the added cards, the following were removed:

Click to see removed cards

| Card Name | Set |

|---|---|

| Aether Vial | DST |

| Alpha Kavu | PLS |

| Awakening | STH |

| Beseech the Queen | SHM |

| Boggart Arsonists | SHM |

| Bone Miser | C19 |

| Brain Freeze | SCG |

| Bridge from Below | FUT |

| Cadaverous Knight | MIR |

| Callaphe, Beloved of the Sea | THB |

| Combustible Gearhulk | KLD |

| Council’s Judgment | CNS |

| Dragonlord Atarka | DTK |

| Evermind | SOK |

| Fomori Nomad | FUT |

| Forced Fruition | LRW |

| Freyalise, Llanowar’s Fury | C14 |

| Gempalm Polluter | LGN |

| Gemstone Mine | TSB |

| Godsire | ALA |

| Hundred-Handed One | THS |

| Jubilant Mascot | BBD |

| Kari Zev, Skyship Raider | AER |

| Korlash, Heir to Blackblade | FUT |

| Kozilek, Butcher of Truth | UMA |

| Land Tax | BBD |

| Liliana’s Devotee | M21 |

| Man-o’-War | VIS |

| Marauding Raptor | M20 |

| Mischievous Quanar | SCG |

| Murderous Cut | KTK |

| Noble Benefactor | WTH |

| Ormos, Archive Keeper | JMP (M21) |

| Phyrexian Obliterator | A25 |

| Pteramander | RNA |

| Skullclamp | CMD |

| Splinter Twin | ROE |

| Springjack Shepherd | EVE |

| Stonybrook Banneret | MOR |

| Tarmogoyf | FUT |

| Temporal Manipulation | UMA |

| Training Grounds | ROE |

| Triplicate Spirits | M15 |

| Tuktuk the Explorer | CM2 |

| Uro, Titan of Nature’s Wrath | THB |

| Vampire Nocturnus | M10 |

| Vodalian Illusionist | WTH |

| Wizened Cenn | LRW |

| Workhorse | EXO |

| Yavimaya Scion | ULG |

Finally, this is the entirety of The List for Adventures in the Forgotten Realms:

Frequently Asked Questions

Which platforms does the Epic Games Store support?

The Epic Games Store currently offers PC and Mac support. You can check platform compatibility for individual titles by referring to the “About Game” section of any product page.

What are the future plans for the Epic Games Store?

You can find upcoming features, developer updates, and major known issues on our Epic Games Store Roadmap on Trello. We’ll also share significant updates with you on our news feed and social media pages such as Facebook, Twitter, Instagram, and YouTube.

Why does the Epic Games Store make exclusivity deals?

Exclusives are a part of the growth of many successful platforms for games and for other forms of digital entertainment, such as streaming video and music.

Epic works in partnership with developers and publishers to offer games exclusively on the store. In exchange for exclusivity, Epic provides them with financial support for development and marketing, which enables them to build more polished games with significantly less uncertainty for the creators.

In addition, creators will earn 88% of all the revenue from their game, while most stores only offer 70%.

What is the Support-A-Creator program?

The Support-A-Creator program enables content Creators to earn money from games in the Epic Games Store by using Creator Links and Creator Tags. Learn more about the Support-A-Creator program here.

What’s this about free games?

Epic will be offering a new free game available each week throughout 2021. When you claim a free game, it’s yours to keep — even after the game is no longer available to new customers for free.

I claimed a free game but don’t see it on my account now, why?

Once you claim a free game, it’s yours to keep. If you come back later and don’t see it your account, please check to see if you have multiple accounts. If you created an Epic account using an @gmail.com email address, log in to it directly using your Gmail password; using the Google login button will create a distinct account even if it’s tied to the same @gmail.com email address. And check to see if you have both a console-linked account (logging in via PlayStation, Xbox, or Nintendo account) and a separate Epic account. If you still encounter issues, please contact player support here.

Can I try a game before I buy it?

Some publishers occasionally offer demos or free trial periods for certain non-free games from time to time (for example, a Free Weekend trial). During a free trial period, you can download and play a trial version of the game before you decide to purchase, but you can no longer access the game when the trial period ends.

How do refunds work on the Epic Games Store?

All games are eligible for refund within 14 days of purchase for any reason, as long as you’ve had the game running for less than 2 hours. You will not be eligible for refunds for games from which you have been banned or for which you have otherwise violated the Terms of Service. Learn more about our refund policy here.

How do I contact support?

You can contact our support team here. We also recommend browsing our support center articles, which may help answer questions or resolve issues.

Is my Epic Games account secure?

The Epic account system powers Fortnite, Rocket League, the Epic Games Store, and Unreal Engine. This account system has never been compromised. However, specific individual Epic accounts have been compromised by hackers using lists of email addresses and passwords leaked from other sites which have been compromised.

If you use the same email address and password on Epic as you used on another site which has been compromised, then your account is vulnerable to attack. To secure your Epic account, use a unique password, and enable multi-factor authentication. You can learn more about the measures we take to protect your account and what you can do to stay safe here.

What languages does the Epic Games Store support?

The Epic Games Store currently supports English, Arabic, German, Spanish (Spain), Spanish (Latin America), French, Italian, Japanese, Korean, Polish, Portugeuse, Russian, Thai, Turkish, Simplified Chinese, and Traditional Chinese. In-game language support varies per game, as provided by the developer; check each game’s store page for language availability.

Does the Epic Games Store support regional pricing?

Yes, we do support regional pricing in more than 190 countries and over 30 territories. We also have a set of suggested regional discounts for developers based on local norms that are regularly reviewed.

Which currencies do you accept and in which currencies do you display prices?

The Epic Games Store currently accepts 43 currencies (USD, EUR, GBP, PLN, BRL, UAH, RUB, KRW, JPY, TRY, AUD, CAD, DKK, NOK, SEK, CZK, ILS, CHF, MXN, PEN, HUF, CLP, SAR, AED, RON, NZD, ZAR, INR, COP, CSC, UYU, HKD, IDR, MYR, PHP, SGD, THB, VND, KZT, QAR, BGN, TWD, CNY). We’re working to bring more currencies online.

If your currency is not on the list, you’ll see the prices displayed in US Dollars, but will still pay in your local currency according to the current exchange rates. In some countries paying in US Dollars may incur additional bank conversion fees. We are working on expanding the list of supported currencies.

Which payment methods are supported?

The Epic Games Store supports credit cards, PayPal, and a variety of alternative payment methods. This is a list of the alternative payment methods we currently support. Methods carrying additional payment processing fees are marked with an *asterisk.

Where is the Epic Games store available?

The Epic Games Store is available to players in most countries in the world except where prohibited by US law, such as North Korea and Iran. Certain regions may have additional legal requirements that you may need to implement in your game in order to be compliant and to be distributed there.

Which currencies do you accept and in which currencies do you display prices?

The Epic Games Store currently accepts 43 currencies (USD, EUR, GBP, PLN, BRL, UAH, RUB, KRW, JPY, TRY, AUD, CAD, DKK, NOK, SEK, CZK, ILS, CHF, MXN, PEN, HUF, CLP, SAR, AED, RON, NZD, ZAR, INR, COP, CSC, UYU, HKD, IDR, MYR, PHP, SGD, THB, VND, KZT, QAR, BGN, TWD, CNY). We’re working to bring more currencies online.

If your currency is not on the list, you’ll see the prices displayed in US Dollars, but will still pay in your local currency according to the current exchange rates. In some countries paying in US Dollars may incur additional bank conversion fees. We are working on expanding the list of supported currencies.

Sentiment supports uneasy market gains ahead of Jackson Hole

Sentiment lifted by US budget progress

It is undoubtedly a statement of the blinding obvious that sentiment is driving markets currently, as it always does. That said, these days it is harder and harder to find an underlying cause for swings in sentiment, which appears most days to have a life of its own. Today though, one development may be helping, and that is the US House of Representatives adopting a $3.5tr budget resolution, which should also aid the passage of the $550bn infrastructure bill and spare us from Filibusters in the Senate. That’s good news in terms of the outlook for US growth. And this probably helped US Treasury bond yields to stage a decent rally yesterday by recent standards, with the 10Y yield rising a little over 4bp to 1.294%.

What happens today is a little harder to call, with sentiment positive but vulnerable to shifts ahead of the Jackson Hole conference which features Fed Chair Powell on Friday. Part of the sentiment improvement may lie with recent thoughts that this weekend’s conference will not deliver any further insight into the timing of any Fed taper. Or possibly that it may temper some recent suggestions that this taper will be more imminent than first thought likely. I suspect we will still be no wiser in terms of the Fed’s intentions by Monday morning, and that may be enough for the optimists to keep sentiment positive.

Positive sentiment is also presumably behind a slightly weaker USD over the last couple of days. EURUSD has risen to 1.1756 from about 1.1740 this time yesterday, and we’ve also seen some reasonably broad (if minor) gains in Asian FX. The THB is the standout here on suggestions that it may relax its movement restrictions and learn to live with the virus. But with low levels of vaccination, and still high cases and death rates (Thailand ranks 12th globally today for daily Covid-19 deaths on Worldometer’s figures) this seems a contentious decision. In any case, we doubt even vaccinated tourists will be rushing to the beaches of Thailand anytime soon just because they open their borders. Potential tourists also have to consider how they will be greeted on their return home. 2 weeks of mandatory quarantine in a hotel can really spoil that holiday feeling. Prakash Sakpal states that he is not “rushing to revise our end-year USD/THB forecast of 35.00 just yet given that the underlying economic fundamentals remain extremely unfriendly for this currency (spot 32.89)”

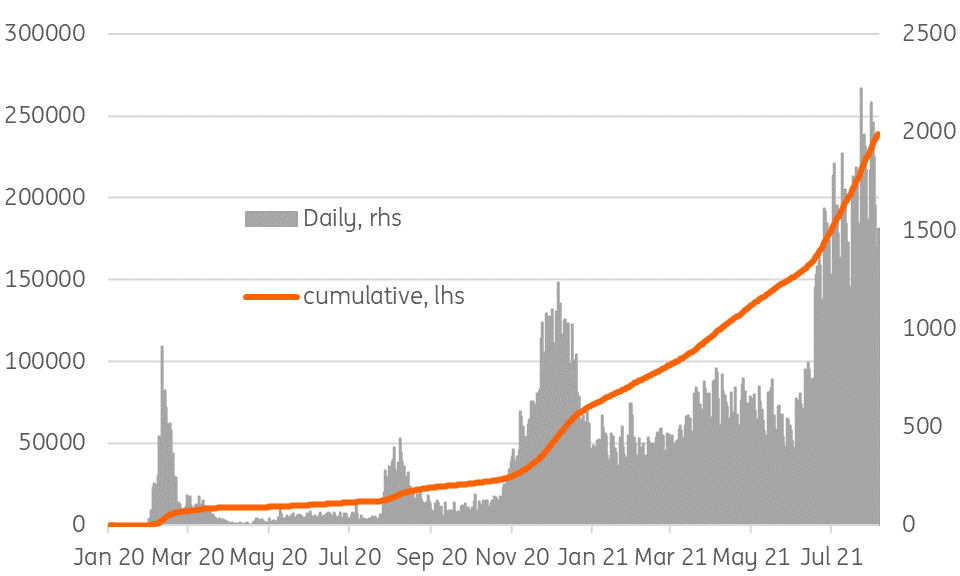

The KRW was also at the top end of the pack in terms of Asian FX, ahead of a very tightly considered rate decision by the Bank of Korea tomorrow. 10 of 19 economists surveyed by Bloomberg (including ourselves) are suggesting that the BoK will hold fire tomorrow, (perhaps taking their lead from the Reserve Bank of New Zealand) against the tricky backdrop of the rising Delta variant across the region). South Korea’s current daily Covid-19 case tally is more than 1,500. That is high for Korea, but it is down from the 2000+ it was recording a few weeks ago. You could argue that this is enough to allow for a rate hike tomorrow, especially given yesterday’s release of some further rapid increases in household debt. But it is a very close call. A BoK hike is certainly coming, so if not now, then within a month or two.

Korea: Daily Covid cases and cumulative total

Quiet day ahead for Macro data

There isn’t much on the economic calendar in either the G-7 or Asia-Pacific to get your teeth into today. Some import-dominated trade data has pushed the July NZ trade surplus into deficit by more than expected this morning (-NZD402m), which is weighing on the NZD. We have seen quite a few trade figures across the region illustrating that pattern of more rapid gains in imports than exports, which may reflect the impact of re-opening. That’s encouraging on some levels, but it may put some of the more fragile currencies under strain as they emerge from the latest wave.

Prakash Sakpal gives us his thoughts on Malaysian inflation for July also due today. “After hitting a four-year high of 4.7% YoY in April this year, Malaysia’s inflation slowed to 3.4% in June. We expect today’s data to show a further drop to 2.9% YoY, in line with the market consensus. This deceleration stems from softer domestic demand amidst the worst Covid-19 outbreak currently, while base effects also fade. By product types, housing and transport have been the main inflation drivers here. We see inflation settling down between 2-3% in the second half of 2021, putting the full-year average near the low end of Bank Negara Malaysia’s 2.5-4.0% forecast range for the year. Still, elevated inflation doesn’t have any bearing on the BNM policy, which we expect to remain in a holding pattern well into 2022”.

Source: ING

More than 150 A350 freighter sales a ‘good return’ for Airbus

25 / 08 / 2021

By Dominic Perry, FlightGlobal

Airbus will need to sell at least 150 examples of its A350 freighter for the programme to be considered a success, according to a leading analyst.

Jonathan McDonald, head analyst at consultancy IBA Group, said that sales of 150-200 units would mark a good return for the proposed freighter derivative.

Airbus last month announced that it had obtained board approval to launch the A350F, which will be substantially based on the -1000 variant and have a payload of around 90 tonnes.

McDonald said the airframer is “clearly targeting the heavy widebody sector” which is “pretty Boeing dominated” at present, thanks to its 777F and 747-8F programmes.

Launch of the A350F is effectively an admission by Airbus that it is “a little bit under-represented in the heavy freighter market”, he added.

A payload of 90t would put it “slap-dab in MD-11F territory”, says McDonald. There are 104 examples of the legacy McDonnell Douglas type still in service, with a further six examples parked, according to IBA InsightIQ data; the majority are operated by FedEx and UPS.

Securing orders from the two logistics giants will be key for the new programme, he said.

However, Airbus will need to do more than replace MD-11Fs to hit the 150-sales mark and could also target operators of ageing 747-400 freighters.

IBA InsightIQ data shows there are 194 examples, both factory built and conversions, still in operation, plus another 13 parked aircraft.

While the maximum payload of the -400F is higher, at 113 tonnes, with the termination of the 747-8F programme next year, Airbus could still take advantage of a replacement need.

And should Airbus deliver the A350F by 2025 as planned, then it will at least have first-mover advantage over Boeing, which has yet to decide whether to offer a freighter variant of its developmental 777X.

In McDonald’s view a 777-8F is unlikely to arrive much before 2028, giving its rival a three-year head-start.

“Airbus has seen a little bit of a gap there and it believes it can leapfrog Boeing with a new technology aircraft,” he said.

Boeing still holds 52 orders for the current -200LR-based 777F, according to the airframer’s data, and is likely to continue production in parallel with the first passenger 777-9s.

To date, it has handed over 209 examples of the widebody freighter since first delivery in 2009, its data shows.

In contrast, Airbus earlier this year cancelled the three outstanding orders for its only factory-built freighter programme, the A330-200F. It has delivered just 38 examples of the widebody cargo variant.

Airbus is also banking on the fuel efficiency of the A350F to see off any potential competition from the 777-300ERSF conversion programme being developed by Israel Aerospace Industries (IAI) and lessor GECAS.

While McDonald said the IAI/GECAS conversion will deliver a “hell of an aircraft” he noted that “you have got to remember that when those aircraft [re-enter service] some of those earliest aircraft will be 19-20 years old”.

And although the 777’s GE90-115BL is a “great engine” it is now “technically superseded by the Trent XWB” on the A350, he said. Therefore “Airbus is counting on the better fuel efficiency” of its new-build freighter to be a key differentiator for certain operators.

For others, however, a list price likely to be three times higher than that of a converted 777 could be too steep.

That view is supported by IAI Aviation Group general manager Yossi Melamed, who shrugs off threat from the A350F. “In our eyes, conversion eyes, we don’t see a [new-build] freighter as a competitor,” he said, adding that such aircraft tend to be acquired by companies “which have a philosophy” of using new-build aircraft. “I’m not in this game.”